It’s well known that auto insurance companies don’t want policyholders to compare prices from other companies. People who shop for lower prices will presumably move their business because there is a high probability of finding lower prices. A recent survey revealed that drivers who compared rate quotes regularly saved as much as $865 annually compared to other drivers who didn’t regularly shop around.

If finding low prices for auto insurance is the reason for your visit, then having a grasp of how to shop and compare insurance premiums can make shopping around easier.

Really, the only way to find better pricing on car insurance rates is to start doing an annual price comparison from insurance carriers that insure vehicles in San Jose.

Really, the only way to find better pricing on car insurance rates is to start doing an annual price comparison from insurance carriers that insure vehicles in San Jose.

- Step 1: Get a basic knowledge of individual coverages and the measures you can control to keep rates low. Many factors that are responsible for high rates such as traffic violations and a poor credit score can be eliminated by improving your driving habits or financial responsibility. Read the full article for ideas to help keep prices low and get additional discounts that may be available.

- Step 2: Compare rates from independent agents, exclusive agents, and direct companies. Exclusive and direct companies can only give rate quotes from one company like Progressive and State Farm, while independent agents can provide prices from many different companies.

- Step 3: Compare the new rates to the premium of your current policy to see if switching to a new carrier will save money. If you find a better price and buy the policy, make sure the effective date of the new policy is the same as the expiration date of the old one.

- Step 4: Give notification to your agent or company of your intention to cancel your current coverage. Submit a down payment along with a signed application to your new agent or company. As soon as you have the new policy, put the new certificate verifying proof of insurance in an easily accessible location.

A good tip to remember is to make sure you enter similar deductibles and liability limits on every price quote and and to get prices from as many different insurance providers as possible. This ensures a fair price comparison and a thorough selection of prices.

If you already have coverage or are just looking to switch companies, you can follow these tips to buy cheaper insurance without sacrificing coverage. Shopping for the best-priced protection in San Jose is not as confusing as people think. Smart buyers only need an understanding of the least time-consuming way to compare different rates online.

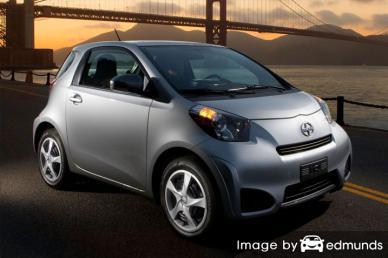

Reducing your Scion iQ insurance rates can be surprisingly simple. You just need to spend a few minutes getting comparison quotes to discover which company has cheaper San Jose car insurance quotes.

The companies shown below can provide price comparisons in California. If several companies are displayed, we suggest you visit as many as you can to get a more complete price comparison.

Verify you’re applying every discount

Car insurance companies don’t list all discounts very well, so the following list contains some of the more common in addition to some of the lesser obvious credits available to lower your premiums when you buy San Jose car insurance online.

- Passenger Safety Discount – Vehicles equipped with air bags or motorized seat belts could see savings of 20% or more.

- Pay Upfront and Save – If you can afford to pay the entire bill instead of making monthly payments you can avoid monthly service charges.

- Distant Student – Youth drivers who attend college more than 100 miles from San Jose without a vehicle on campus could get you a discount.

- Military Rewards – Being deployed with a military unit could qualify you for better insurance rates.

- Anti-lock Brake Discount – Anti-lock brake equipped vehicles are safer to drive so companies give up to a 10% discount.

- Seat Belts Save more than Lives – Using a seat belt and requiring all passengers to wear their seat belts could save 15% off PIP or medical payments premium.

- Clubs and Organizations – Being in a qualifying organization could trigger savings on insurance.

- Theft Prevention Discount – Vehicles equipped with anti-theft or alarm systems can help prevent theft and earn discounts up to 10% off your San Jose car insurance quote.

While discounts sound great, it’s important to understand that some credits don’t apply to the entire policy premium. A few only apply to specific coverage prices like comprehensive or collision. So when it seems like all the discounts add up to a free policy, it doesn’t quite work that way.

The best insurance companies and their possible discounts are included below.

- GEICO may have discounts that include membership and employees, anti-theft, seat belt use, multi-vehicle, anti-lock brakes, and military active duty.

- MetLife offers discounts including accident-free, good driver, multi-policy, claim-free, good student, and defensive driver.

- Progressive offers premium reductions for multi-vehicle, good student, multi-policy, continuous coverage, online quote discount, and homeowner.

- Travelers offers discounts for multi-policy, multi-car, early quote, payment discounts, IntelliDrive, student away at school, and save driver.

- SAFECO includes discounts for multi-car, safe driver, teen safe driver, anti-lock brakes, bundle discounts, drive less, and homeowner.

- AAA has discounts for good driver, AAA membership discount, pay-in-full, education and occupation, multi-policy, and good student.

If you want affordable Scion iQ insurance quotes, ask each insurance company which discounts you may be entitled to. Some discounts listed above may not be available in San Jose. If you would like to view providers that can offer you the previously mentioned discounts in California, click here to view.

Find Cheaper Auto Insurance with These Tips

Lots of things are part of the calculation when pricing auto insurance. Some factors are common sense such as your driving record, but some are more transparent like where you live or your vehicle rating. It’s important that you understand the factors that help calculate your auto insurance rates. If you know what positively or negatively impacts your premiums, this allows you to make educated decisions that will entitle you to cheaper rates.

The itemized list below are a few of the “ingredients” utilized by car insurance companies to help set your premiums.

Fast cars cost more to insure – The type of car you own makes a substantial difference in your premium level. The lowest performance passenger cars receive the most favorable rates, but many other things help determine your insurance rates.

Responsible drivers pay better rates – Good drivers get better rates compared to drivers with tickets. Even a single moving violation can increase the cost of insurance twenty percent or more. Drivers who have received flagrant violations like reckless driving, hit and run or driving under the influence may find they need to file a proof of financial responsibility form (SR-22) with their state DMV in order to continue driving.

Insure car and home with the same company – Most larger insurers will give discounts to customers who carry more than one policy such as combining an auto and homeowners policy. Even if you already get this discount, it’s always a smart idea to get quotes from other companies to make sure you are getting the best deal.

Gender is a factor – Over the last 30 years, statistics show females are less aggressive when driving. That doesn’t necessarily mean that females are better drivers. They both are responsible for auto accidents at about the same rate, but guys tend to have higher claims. Not only are claims higher, but men get cited for more serious violations such as driving while intoxicated (DWI) or driving recklessly.

What’s your car’s crash test rating? – Safer cars tend to have better insurance rates. Safe vehicles help reduce the chance of injuries in an accident and reduced instances of injuries means your insurance company pays less which can result in lower premiums. If the Scion iQ scored at minimum an “acceptable” rating on the Insurance Institute for Highway Safety website it may cost less to insure.

Youthful drivers cost more – Inexperience drivers are known to be careless and easily distracted when behind the wheel and because of this, their auto insurance rates are much higher. Older insureds have been proven to be more responsible, statistically cause fewer accidents, and receive fewer citations.

What are good liability insurance limits? – Your auto insurance policy’s liability coverage will protect you when a court rules you are at fault for physical damage or personal injury to other. Your liability coverage provides legal defense coverage which can cost thousands of dollars. This coverage is very inexpensive when compared with rates for comp and collision, so buy as much as you can afford.

Scion iQ insurance loss statistics – Auto insurance companies use claims history when setting rates for each model. Models that the data determines to have higher number or severity of losses will be charged more to insure.

The table below illustrates the loss history for Scion iQ vehicles. For each type of coverage, the loss probability for all vehicles as a whole is a value of 100. Values under 100 indicate a favorable loss history, while percentages above 100 point to more claims or an increased chance of a larger loss.

| Make and Model | Collision | Property Damage | Comp | Personal Injury | Medical Payment | Bodily Injury |

|---|---|---|---|---|---|---|

| Scion iQ | 77 | 81 | 75 |

Empty fields indicate not enough data collected

Data Source: Insurance Institute for Highway Safety for 2013-2015 Model Years

Get rate quotes but buy from a local neighborhood San Jose car insurance agent

Some consumers prefer to have an agent’s advice and that is a personal choice. Agents can help determine the best coverages and help submit paperwork. A good thing about getting free rate quotes online is the fact that you can find better rates but also keep your business local.

To help locate an agent, after submitting this simple form, the quote information is instantly submitted to local insurance agents who can give free rate quotes for your business. It simplifies rate comparisons since you won’t have to visit any agencies due to the fact that quote results will go to your email. If you need to compare rates from one company in particular, you can always jump over to their website and submit a quote form there.

Selecting a insurer requires you to look at more than just a cheap price quote. Get answers to these questions too.

- Do they offer accident forgiveness?

- Which insurance companies are they affiliated with?

- Is the quote a firm price?

- If your car is totaled, how to they determine the replacement cost?

- Can they help ensure a fair claim settlement?

- Is auto insurance their primary focus in San Jose?

If you are wanting to find a local agent, you should know the different agency structures and how they function. Auto insurance policy providers are considered either independent or exclusive depending on the company they work for. Either one can do a good job, but it is important to understand why they differ because it can impact the type of agent you choose.

Exclusive Auto Insurance Agents

Agents of this type work for only one company and examples are State Farm, AAA, and Liberty Mutual. They generally cannot provide rate quotes from other companies so they have no alternatives for high prices. Exclusive insurance agents receive a lot of sales training on what they offer and that allows them to sell at a higher price point. Many people buy from exclusive agents mainly due to the brand and the convenience of having a single billing for all their coverages.

Listed below are exclusive insurance agents in San Jose who may provide you with comparison quotes.

- Farmers Insurance: Jose Manabat

1620 Oakland Rd #D107 – San Jose, CA 95131 – (408) 437-5456 – View Map - Farmers Insurance – Jeff Senigaglia

950 S Bascom Ave #2113 – San Jose, CA 95128 – (408) 297-6686 – View Map - Dick Alesch – State Farm Insurance Agent

164 N Bascom Ave a – San Jose, CA 95128 – (408) 918-0877 – View Map

Independent Auto Insurance Agencies

Agents that elect to be independent are not employed by any specific company so they have the ability to put coverage with a variety of different insurance companies and find you the best rates. To move your coverage to a new company, your agent can just switch to a different company and you don’t have to switch agencies.

When comparing auto insurance rates, we recommend you get some free quotes from at least one independent agent to get the most accurate price comparison. Most can insure with small mutual carriers which can save you money.

Shown below is a short list of independent insurance agents in San Jose that are able to give price quote information.

- All Solutions Insurance – San Jose

574 Blossom Hill Rd – San Jose, CA 95123 – (408) 225-4300 – View Map - Cya Insurance Agency From Sn

1271 Story Rd #50 – San Jose, CA 95122 – (408) 971-4172 – View Map - LNA Insurance Agency Inc

999 Story Rd – San Jose, CA 95122 – (408) 280-5815 – View Map

Auto insurance is unique, just like you

When it comes to choosing a policy for your vehicles, there is no one-size-fits-all type of policy. Your situation is unique and your auto insurance should unique, too.

These are some specific questions might help in determining whether your personal situation will benefit from professional help.

- Do I need rental car coverage?

- Can I cancel at any time?

- Will damage be repaired with OEM parts?

- Am I covered if I have no license?

- Do I need special endorsements for business use of my vehicle?

- Is my ex-spouse still covered by my policy?

If you can’t answer these questions but a few of them apply, you might consider talking to a licensed agent. If you don’t have a local agent, complete this form or you can also visit this page to select a carrier It is quick, free and can provide invaluable advice.

Quote more to save more

When getting San Jose car insurance quotes online, don’t be tempted to skimp on coverage in order to save money. Too many times, consumers will sacrifice liability limits or collision coverage only to find out that the savings was not a smart move. Your focus should be to find the BEST coverage at the best price, but don’t skip important coverages to save money.

In this article, we presented some good ideas how you can reduce Scion iQ insurance premium rates online in San Jose. The key concept to understand is the more you quote San Jose car insurance, the better your comparison will be. Consumers could even find that the lowest priced auto insurance comes from some of the lesser-known companies. They can often insure niche markets at a lower cost than their larger competitors like Allstate or State Farm.

Additional auto insurance information can be found at these links:

- Protecting Teens from Drunk Driving (Insurance Information Institute)

- Who Has the Cheapest Car Insurance Rates for a Learners Permit in San Jose? (FAQ)

- What Car Insurance is Cheapest for a Toyota Tundra in San Jose? (FAQ)

- Who Has Cheap San Jose Auto Insurance Quotes for Drivers with Bad Credit? (FAQ)

- How Much are San Jose Auto Insurance Quotes for Felons? (FAQ)

- Determining Auto Insurance Rates (GEICO)

- Understanding Car Crashes Video (iihs.org)

- Safety Belts FAQ (iihs.org)

- Parking Tips to Reduce Door Dings (State Farm)